History of Critical Raw Materials

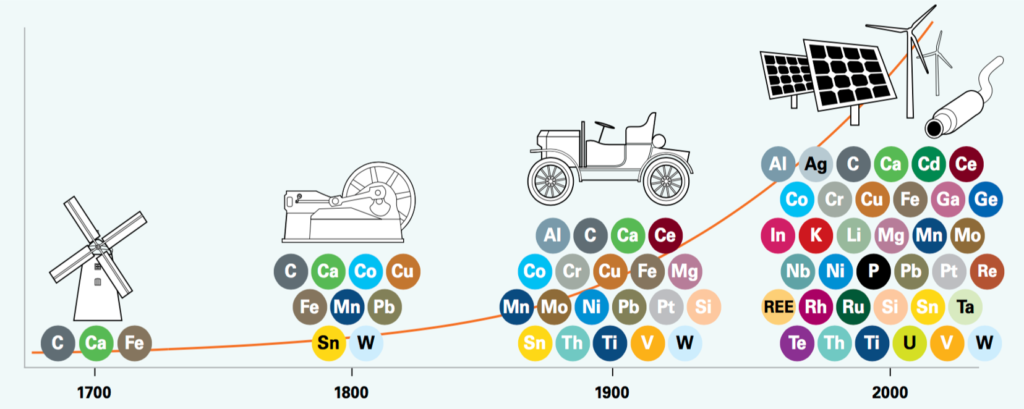

In the last 20 years, the importance of rare and critical elements has continuously increased as they became essential for a sustainably functioning modern society. The European Commission acknowledges the importance of sufficient and affordable access to such elements like lithium, cobalt, cobalt, natural graphite, gallium, germanium, magnesium, copper, aluminum and rare earth elements (REEs); all of them crucial for the global economy, for decarbonization, digitization, and other high-tech applications.

The term “critical raw material” (which includes rare earth elements) doesn’t describe the respective element’s lack of presence in the earth’s crust, but refers to the element’s limited availability. The precarious supply of these metals can be put down to a variety of reasons, of which the most prominent ones are concentrated production in only a few select regions of the world, combined with an increasing demand for the respective raw material.

Swiss and European industries depend largely on imports of rare and critical elements. Market distortions lead to a high volatility in price and availability. A lack of transparency in raw material supply chains bears the risk of socially and ecologically poor conditions in mining, manufacturing and recycling. These and other factors can endanger the economic growth and development of countries dependent on these elements. It can further lead to a loss of innovative capacity and hinder the deployment of low-carbon technologies in industrialized countries, including Switzerland.

Discovery of the Mountain Pass deposit of rare earth metals in the USA

Foundation of the Swiss National Science Foundation

China: Export restrictions on rare earth metals

Foundation of DERA, Germany

US Executive Order 13817 on a “Federal Strategy To Ensure Secure and Reliable Supplies of Critical Minerals”

Critical Raw Materials for Switzerland

With increasing digitalization and the transition towards decarbonization, the global demand for critical raw materials is rising rapidly. Geopolitical conflicts have brought supply security to the forefront of political attention. Switzerland does not produce any of the raw materials classified as critical and strategic by the EU, such as rare earth metals, cobalt, nickel, lithium, or copper. These materials are imported into Switzerland, often as semi-processed intermediates. Due to heavy reliance on EU imports and its concentration on suppliers like China, Switzerland is indirectly vulnerable to supply shortages, price fluctuations, and other risks in the supply chain. There is currently a lack of systematic assessment of these dependencies and corresponding risk mitigation strategies.

Many countries have taken measures to secure their raw material supply. The EU has introduced the European Critical Raw Materials Act (CRMA), promoting local production, sustainable practices, and strategic autonomy. The Circular Economy Action Plan aims to foster a circular economy. The USA leverages the Inflation Reduction Act and the Defense Production Act to strengthen domestic capacities. China implements export restrictions and invests heavily in foreign mining projects under the Belt and Road Initiative. International collaborations such as the Minerals Security Partnership are building strategic alliances for raw material security.

All these measures aim for greater independence and supply security of critical raw materials, utilizing a wide range of domestic and foreign policy instruments.

A structured risk assessment and formulation of a raw material strategy are essential. This involves defining objectives and frameworks, identifying relevant raw materials, analyzing supply chain risks, prioritizing materials, and defining and implementing risk mitigation strategies – in coordination with international partners, especially the EU.

International Political Instruments

Many countries worldwide are taking steps to secure their supply of metallic raw materials, critical for decarbonization, digitalization, aviation, and defense sectors. Examples include:

European Union (EU)

- European Critical Raw Materials Act (2024): Comprehensive regulation for strategic autonomy and sustainable practices.

- EU Sustainable Batteries Regulation (2023): Guidelines for sustainable battery production and usage.

- Circular Economy Action Plan (2020): Promoting circular economy and recycling.

United States

- Inflation Reduction Act (2022): Tax incentives and financing for critical raw material supply pathways.

- Defense Production Act (1950): Strengthening domestic capacities for critical raw material production and processing.

- Executive Order 14017 (2021): Introduction of a national strategy for reliable critical raw material supply.

China

- Regulation on Export Controls for Gallium and Germanium (2023): Export restrictions on essential raw materials for microchip production.

- Foreign Direct Investments: Investments in mining and raw material projects abroad, particularly under the Belt and Road Initiative.

Canada and Australia

- Various strategies promoting international cooperation, geological exploration, and development of critical minerals.

International Cooperations

- Collaborations such as the Minerals Security Partnership and Sustainable Critical Minerals Alliance.

For more detailed information and sources, please visit: